kotyonok.site

Learn

What Happens To Annuity After Death

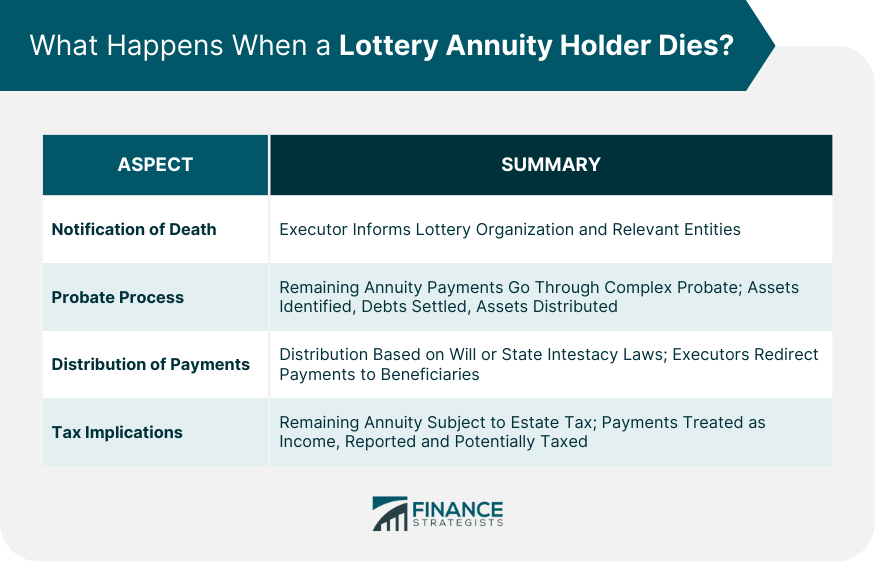

occurs upon the death of the annuitant/owner, the entire gain in the annuity is subject to income taxes when received by the beneficiary. For example, you. The account owner's name and address · Date of death · Beneficiary info (contact info for spouse and/or executor info). Annuities are not as complicated after the owner's death as they are during lifetime. Every annuity has a beneficiary designation with a death beneficiary. Military retired pay stops upon death of the retiree! The Survivor Benefit Plan (SBP) allows a retiree to ensure, after death, a continuous lifetime annuity for. Continuing payments. Payments cease upon death, but most annuities have options to continue payments to the surviving spouse or another loved one. Distributions. Defined Benefit Supplement distribution If you die after retirement, depending on your Defined Benefit Supplement annuity option, your DBS balance may be. If you die, normally your annuity payments will stop and the pension fund used to buy your annuity will be lost. Value protection allows a lump sum (after tax if applicable) to be paid on the death of the annuitant. Value protection is available both for scheme pensions. When that annuitant dies, payments stop and no more benefits are paid out. That means any money remaining in the annuity account goes to the life insurance. occurs upon the death of the annuitant/owner, the entire gain in the annuity is subject to income taxes when received by the beneficiary. For example, you. The account owner's name and address · Date of death · Beneficiary info (contact info for spouse and/or executor info). Annuities are not as complicated after the owner's death as they are during lifetime. Every annuity has a beneficiary designation with a death beneficiary. Military retired pay stops upon death of the retiree! The Survivor Benefit Plan (SBP) allows a retiree to ensure, after death, a continuous lifetime annuity for. Continuing payments. Payments cease upon death, but most annuities have options to continue payments to the surviving spouse or another loved one. Distributions. Defined Benefit Supplement distribution If you die after retirement, depending on your Defined Benefit Supplement annuity option, your DBS balance may be. If you die, normally your annuity payments will stop and the pension fund used to buy your annuity will be lost. Value protection allows a lump sum (after tax if applicable) to be paid on the death of the annuitant. Value protection is available both for scheme pensions. When that annuitant dies, payments stop and no more benefits are paid out. That means any money remaining in the annuity account goes to the life insurance.

An annuity death benefit is a form of payment made to a person identified as a beneficiary in an annuity contract, usually paid after the annuitant dies. Most. Your spouse may receive 55% of your earned annuity, based on your service length and salary at the time of your death. If you have a former spouse from whom you. But be aware that if you opted for a single-life annuity, the payments would stop when you die. What happens if I die after the age of 75? If you die after If your death occurs after you have retired, benefits to your designated beneficiaries will be determined by the annuity contract purchased at the time of your. When an annuity owner dies, the beneficiary receives the remaining value or a guaranteed minimum amount based on the contract terms. When you die before getting all of your principal back, the insurance company pays the difference to your beneficiaries. Of course, this means you get smaller. Pension Payment Option · Single-Life Allowance: provides the maximum pension benefit, but there is no continuing benefit to a beneficiary after you die. · Joint-. If the claim involves the death of an employee, it will be assigned to a specialist once OPM has received the death package from the employing agency and. Upon the death of the owner, if the owner is a person, the beneficiary (or joint owner if one is named) of the contract generally has the following options. A. Once you start receiving monthly benefit payment, you cannot change your contingent annuitant. Option 5: Month Term Certain Annuity. If you die before. A primary beneficiary is designated by the annuity owner to receive the death benefit upon their death. When an annuity's owner or annuitant dies, the contract pays a death benefit to the named beneficiary. An annuity is an insurance product that pays out income, and can be used as part of a retirement strategy. Annuities are a popular choice for investors who. In an annuity, everything you earn is tax‐deferred, so your money grows faster. If you purchase an annuity with after‐tax money, only a portion of your. A single-life annuity gives you a periodic retirement payment for the rest of your life, but no payments will be made after your death to a beneficiary. Example. Deferred annuities will pay out a lump sum to your beneficiaries upon death. So, it depends on your annuity and what will happen to it when you die. Can an. Mortality credits are an added benefit whenever a lifetime annuitization takes place from a life insurance company. Premiums paid by policy holders who die. Payments after your death may go to your designated beneficiary. Example: If you choose a year fixed-period payout and die within the first 10 years, the. Most lotteries will consider your remaining annuity payments part of your estate after your death. If you left a will, you can determine what. At the time of your death or your annuity partner's death, income drops to two-thirds of the amount to the survivor. This is the only two-life annuity.

Dividend Investing Etf

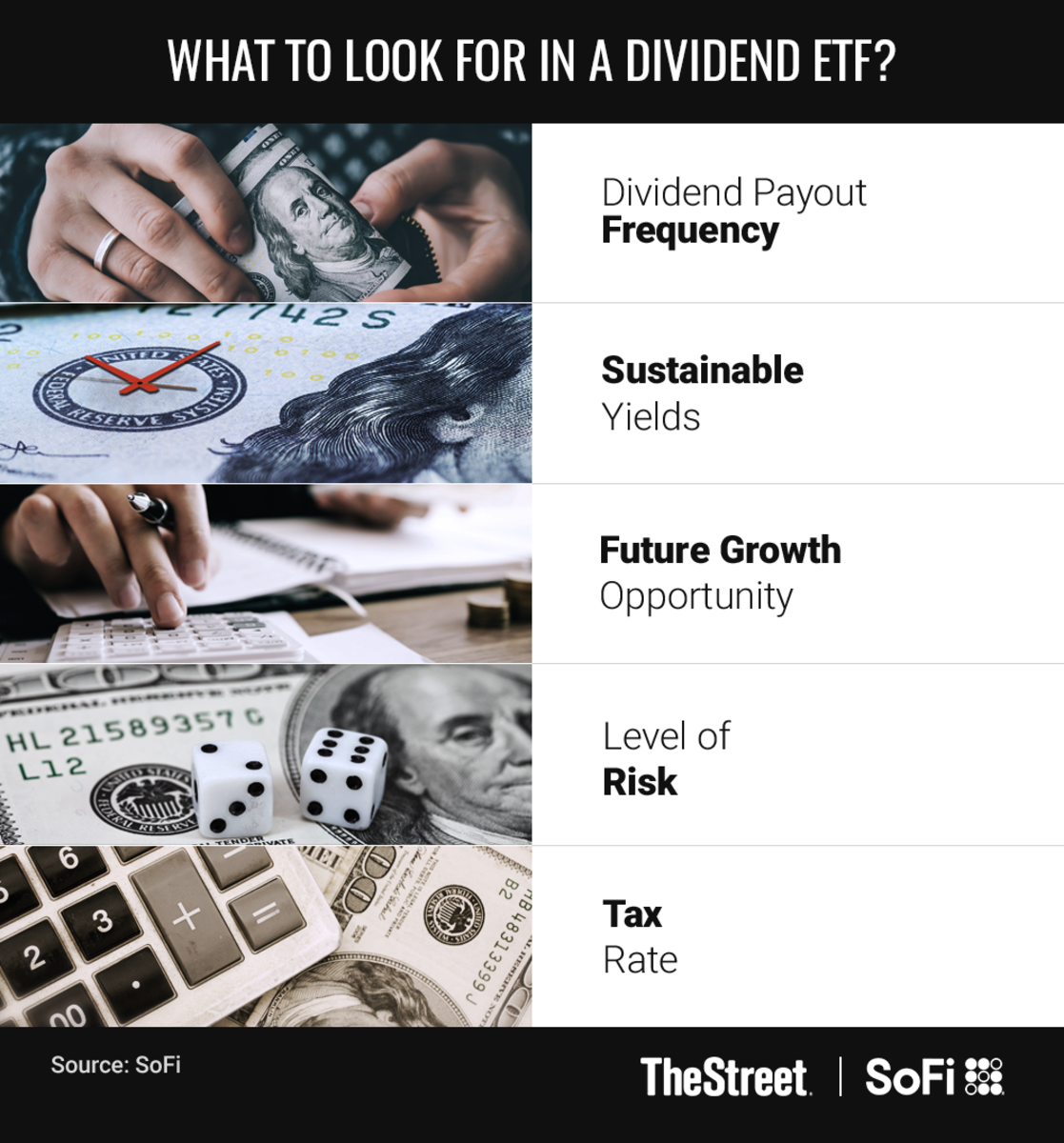

Dividend ETFs and dividend stocks have multiple similarities, such as income generation and overall market risk. Movers in US High Dividend ; DGRO. iShares Core Dividend Growth ETF, +$M ; SCHD. Schwab U.S. Dividend Equity ETF, +$M ; RDVY. First Trust NASDAQ Rising. 7 Best High-Dividend ETFs to Buy Right Now ; Franklin Income Focus ETF (INCM), %, % ; Invesco High Yield Equity Dividend Achievers ETF (PEY), %, %. The Fund will normally invest at least 90% of its total assets in dividend paying common stocks that comprise Index. These companies have increased their annual. Learn more about ETFs that aim to result in dividends and yields for traders who are seeking income or who may be risk-averse. Amidst the current period of elevated inflation, investing in dividends can offer an additional source of regular income. VanEck's Dividend ETF searches out. The iShares Core High Dividend ETF seeks to track the investment results of an index composed of relatively high dividend paying U.S. equities. The Global X SuperDividend® US ETF (DIV) invests in 50 of the highest dividend yielding equity securities in the United States. Dividends on ETFs. There are 2 basic types of dividends issued to investors of ETFs: qualified and non-qualified dividends. J.K. Lasser. If you own shares of an. Dividend ETFs and dividend stocks have multiple similarities, such as income generation and overall market risk. Movers in US High Dividend ; DGRO. iShares Core Dividend Growth ETF, +$M ; SCHD. Schwab U.S. Dividend Equity ETF, +$M ; RDVY. First Trust NASDAQ Rising. 7 Best High-Dividend ETFs to Buy Right Now ; Franklin Income Focus ETF (INCM), %, % ; Invesco High Yield Equity Dividend Achievers ETF (PEY), %, %. The Fund will normally invest at least 90% of its total assets in dividend paying common stocks that comprise Index. These companies have increased their annual. Learn more about ETFs that aim to result in dividends and yields for traders who are seeking income or who may be risk-averse. Amidst the current period of elevated inflation, investing in dividends can offer an additional source of regular income. VanEck's Dividend ETF searches out. The iShares Core High Dividend ETF seeks to track the investment results of an index composed of relatively high dividend paying U.S. equities. The Global X SuperDividend® US ETF (DIV) invests in 50 of the highest dividend yielding equity securities in the United States. Dividends on ETFs. There are 2 basic types of dividends issued to investors of ETFs: qualified and non-qualified dividends. J.K. Lasser. If you own shares of an.

Dividend ETFs are designed to provide regular income to investors by investing in a diversified basket of dividend-paying equities. ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will. Best dividend growth ETFs ; Vanguard Dividend Appreciation ETF (VIG), % ; ProShares S&P Dividend Aristocrats ETF (NOBL), % ; iShares Core Dividend. ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual. This is a list of all Dividend ETFs traded in the USA which are currently tagged by ETF Database. Please note that the list may not contain newly issued ETFs. Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high. Why Invest in NOBL? The only ETF focusing exclusively on the S&P Dividend Aristocrats—high-quality companies that have not just paid dividends but grown. Fund management. Vanguard Dividend Appreciation ETF seeks to track the investment performance of the S&P U.S. Dividend Growers Index, which consists of. Fund details, performance, holdings, distributions and related documents for Schwab International Dividend Equity ETF (SCHY) | The fund's goal is to track. The SPDR® S&P® Dividend ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of. There are a couple of reasons that make dividend-paying stocks particularly useful. First, the income they provide can help investors meet liquidity needs. Investing in Dividend ETFs · Vanguard Dividend Appreciation ETF (VIG) · Fidelity International High Dividend ETF (FIDI) · iShare Core High Dividend ETF (HDV) · SPDR. In the last trailing year, the best-performing Dividend ETF was HDLB at %. The most recent ETF launched in the Dividend space was the AAM Brentview. Dividend ETFs invest in high-yielding dividend stocks to maintain a stable, steady income. · The S&P is a broad-based index of large U.S. stocks, providing. Best dividend ETFs · Vanguard High Dividend Yield ETF (VYM). · Schwab U.S. Dividend Equity ETF (SCHD). · WisdomTree U.S. LargeCap Dividend Fund (DLN). · ProShares. Top Highest Dividend Yield ETFs ; NFLY · YieldMax NFLX Option Income Strategy ETF, % ; TSDD · GraniteShares 2x Short TSLA Daily ETF, % ; OARK. The iShares Emerging Markets Dividend ETF seeks to track the investment results of an index composed of relatively high dividend paying equities in emerging. Dividend ETFs ; Defiance R Enhanced Options Income ETF. IWMY · $ +%. $ M · %. $ ; Defiance Nasdaq Enhanced Options Income ETF. This is a real-time list of all stocks, ETFs and funds yielding more than 4%. See our GUIDE to high yield investing below. The T. Rowe Price Dividend Growth ETF (TDVG) seeks dividend income and long-term capital growth primarily through the common stocks of dividend-paying.

Wood Prices Right Now

The prices listed are the base prices for each type of lumber. If you buy 20+ board feet you'll receive a discount of $ per board foot. Paulson Wood Products is a family-owned sawmill and retail lumberyard located in Petersburgh, NY Prices above are current! Yes, right now, they are current! 5/4 Santos Rosewood live edge. $29 ; Alder 4/4. $8 ; Alder 8/4. $10 ; Arariba 4/4. $20 ; Arariba Live Edge Lumber 5/4. $ A typical price for a Dimensional Lumber is $16 but can range from approximately $ to $ What are common types of Dimensional Lumbers? Lumber and. lumber etf Have you seen the prices of wood latelylumber ETF Have - If you are thinking about buying a house; right now would NOT be an ideal time. -. Biomass Fuels Current Heating Averages – July 1, Updated quarterly. Wood (Bagged ton) Current Average Price is $ BTU 16,,; Conversion. The prices listed are the base prices for each type of lumber. If you buy 20+ board feet you'll receive a discount of $ per board foot, 50+ board feet. Wood is crazy expensive right now. and most seem to believe that the cost is driven by the demand for wood. But financial statements from 4 of the top 5. Graph and download economic data for Producer Price Index by Commodity: Lumber and Wood Products: Lumber (WPU) from Jan to Jul about wood. The prices listed are the base prices for each type of lumber. If you buy 20+ board feet you'll receive a discount of $ per board foot. Paulson Wood Products is a family-owned sawmill and retail lumberyard located in Petersburgh, NY Prices above are current! Yes, right now, they are current! 5/4 Santos Rosewood live edge. $29 ; Alder 4/4. $8 ; Alder 8/4. $10 ; Arariba 4/4. $20 ; Arariba Live Edge Lumber 5/4. $ A typical price for a Dimensional Lumber is $16 but can range from approximately $ to $ What are common types of Dimensional Lumbers? Lumber and. lumber etf Have you seen the prices of wood latelylumber ETF Have - If you are thinking about buying a house; right now would NOT be an ideal time. -. Biomass Fuels Current Heating Averages – July 1, Updated quarterly. Wood (Bagged ton) Current Average Price is $ BTU 16,,; Conversion. The prices listed are the base prices for each type of lumber. If you buy 20+ board feet you'll receive a discount of $ per board foot, 50+ board feet. Wood is crazy expensive right now. and most seem to believe that the cost is driven by the demand for wood. But financial statements from 4 of the top 5. Graph and download economic data for Producer Price Index by Commodity: Lumber and Wood Products: Lumber (WPU) from Jan to Jul about wood.

How much is a cord of cedar wood going for right now in Maine? Rogan King What are pine prices now? Delwood Hallett and 4 others · 5 · 3 · · Jared. 2x4 ; Nominal Product Length (ft.) Price. Pickup ; caret. 2 ft. $/each. 54 nearby | Downey ; caret. 3 ft. $/each. 38 in stock | Huntington Park. Normal range: $ - $ A cord of wood costs $ on average, and prices often range from $ to $ depending on the season, wood type, and where it's. Pricing and Availability. Find Your Local Store · Home > Departments > Lumber Enjoy the convenience of our delivery service, bringing quality lumber right to. This table shows weekly softwood lumber prices in North America for the current week, as well as a 4-week and 52 week averages. Dollars per thousand board feet. Find 2-in x 4-in dimensional lumber at Lowe's today. Shop dimensional lumber and a variety of building supplies products online at kotyonok.site This survey provides the current Maine cash prices, in dollars, rounded to the nearest penny. Wood Pellets: Prices are based on an informal survey of dealers. Appalachian Hardwood Sawtimber Pricing by Species ; Chestnut Oak, $ ; Sugar (Hard) Maple, $ ; Red (Soft) Maple, $ ; Hickory, $ According to Wall Street Journal, price of wood when there was a shortage was about $1, per thousand board feet. This was a major jump in the price of wood. In the face of some manufacturers that are still making record profits, as I've said all year, housing is too expensive right now. We as a whole industry need. Lumber is expected to trade at USD/ board feet by the end of this quarter, according to Trading Economics global macro models and analysts. Beyond our expansive inventory of products, turn to The Home Depot for advice, such as Buying Guides on choosing the right deck materials and railing, electric. I had seen in other forums about "why are these boards so much more now" and was curious as well until I saw wood prices. Right, but, the US. Biomass Fuels Current Heating Averages – July 1, Updated quarterly. Wood (Bagged ton) Current Average Price is $ BTU 16,,; Conversion. Wood Price Surveys ; Bulk, $/ton, $/ton ; Bagged, $/ton, $/ton ; $/bag, $/bag. Read more about why you should track lumber commodity prices daily with Fastmarkets' benchmark lumber prices. Find out more about our lumber price data and. 85% Clear Face. Walnut Lumber. Walnut Lumber Prices per Board Foot as of Aug 25, Call us at for more details. Now Offering Walnut Slabs. I always get the wood off of freecycle or the free section on craigslist, so what do you think I should price mine at. Right now I've made and sold. Now more than ever, it is necessary to anticipate price changes, avoid risk and strategically address new opportunities on the horizon. Our data platform, tools. Price Index by Commodity: Lumber and Wood Products: Hardwood Lumber from FRED News . . No news here. Looks like there's nothing to report right now. Reload.

Is Capital One Savor One A Good Credit Card

Plus, there's no limit on the amount of cash back you can earn and no foreign transaction fees! The Not so Good. You will need excellent-good Credit to get. On the flip side, the SavorOne will be a better choice if you're opening a credit card to make large purchases and need an intro APR to finance those purchases. Applied for the SavorOne card and got declined even though I have a credit score and excellent payment history. What a joke of a company Capital One is. The Capital One Savor Rewards Credit Card will attract those who go out to eat multiple times a week and enjoy frequent trips to the movies. These are the two. If you spend a lot on eating out, groceries, or entertainment, then yes it's be a good card. Just make sure you're applying for the version with. he Capital One SavorOne Cash Rewards Credit Card is an excellent choice for individuals who appreciate dining out and entertainment. With this card, you can. Whether you'd like to earn more cash back on dining and entertainment with the SavorOne card, or earn a flat rate on all your everyday purchases—like gas and. On the flip side, the SavorOne will be a better choice if you're opening a credit card to make large purchases and need an intro APR to finance those purchases. Capital One SavorOne Cash Rewards for Good Credit · High cash back reward on dining and entertainment as well as hotels and rental cars booked through Capital. Plus, there's no limit on the amount of cash back you can earn and no foreign transaction fees! The Not so Good. You will need excellent-good Credit to get. On the flip side, the SavorOne will be a better choice if you're opening a credit card to make large purchases and need an intro APR to finance those purchases. Applied for the SavorOne card and got declined even though I have a credit score and excellent payment history. What a joke of a company Capital One is. The Capital One Savor Rewards Credit Card will attract those who go out to eat multiple times a week and enjoy frequent trips to the movies. These are the two. If you spend a lot on eating out, groceries, or entertainment, then yes it's be a good card. Just make sure you're applying for the version with. he Capital One SavorOne Cash Rewards Credit Card is an excellent choice for individuals who appreciate dining out and entertainment. With this card, you can. Whether you'd like to earn more cash back on dining and entertainment with the SavorOne card, or earn a flat rate on all your everyday purchases—like gas and. On the flip side, the SavorOne will be a better choice if you're opening a credit card to make large purchases and need an intro APR to finance those purchases. Capital One SavorOne Cash Rewards for Good Credit · High cash back reward on dining and entertainment as well as hotels and rental cars booked through Capital.

Holding many credit card, this is the best one that I have used. Great cash back and easy to use app. I have quit using my other cards and just use the SavorOne. The Capital One SavorOne Cash Rewards Credit Card is definitely a card to consider if you spend a lot on dining, groceries and entertainment. If you're looking. The Capital One SavorOne Student credit card* is an excellent option for students looking to earn cash back on their purchases. However, the fool-proof way of. A decent no-fee cash back card that offers additional cash back on dining, entertainment, streaming services, and groceries. The Capital One Savor Cash Rewards Credit Card is a very good card that's worth applying for if you have a + credit score and a big dining-and-entertainment. Great card! No problems paying at different places This capital one card is great for rewards and making purchases easy! Payment a month isn't bad on it! Yes. Good Benefits - Poor Service I use this card a lot because I like the 3% dining cash back benefits. I've had the card 14 months and have accumulated $+ in. What kind of card is the Capital One SavorOne Cash Rewards credit card? Capital One SavorOne Cash Rewards card is a Mastercard. Please note that card details. Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores, plus 1% on all other purchases. 3. Annual Fee. No foreign transaction fee: The ability to earn strong bonus categories in dining and grocery while abroad and without incurring a transaction fee should make. The credit score you need for the Capital One SavorOne (see Rates & Fees) card is or better. That means people with at least good credit have a shot at. Keep reading to learn more about each card. Key takeaways. Quicksilver and SavorOne are both cash back rewards credit cards. Quicksilver offers unlimited %. A top cash back credit card for those who want to earn rewards on food (both at restaurants and grocery stores), entertainment and streaming while avoiding the. Capital One Savor Rewards Credit Card requires good or excellent credit. You may not get approved for this card if you do not have a minimum FICO score. Capital One SavorOne Cash Rewards Credit Card · 0% Introductory APR · Cash Back · EMV · Excellent Credit · Good Credit · Low Interest · No Annual Fee · No Foreign. The Capital One SavorOne Cash Rewards Credit Card offers restaurant goers unlimited 3% cash back on dining out. Select reviews the card so you can decide if. The Capital One SavorOne Student Cash Rewards Credit Card is a great choice if you're a student who wants to build credit and earn rewards on dining. Capital One SavorOne Credit Card—How Does It Work? If you're into getting rewards for dining out, entertainment, and streaming services, the Capital One. The Capital One SavorOne Cash Rewards Credit Card serves as a great introduction to the world of rewards credit cards. For starters, there's no annual fee, so. The Capital One Savor family of cards was designed for consumers with active lifestyles. The cards focus on dining, entertainment, and groceries.

How Do You Thin Gel Nail Polish

What it does: It helps thin thick nail polish without ruining the polishs formula. What else you need to know: Excellent for keeping nail polish at its proper. Ensure your lamp emits UV light at the correct frequency and is positioned around 2 inches from your nails for optimal curing. Do I need to cure regular nail. Nail polish can be thinned using nail polish thinner or a few drops of pure acetone. You can add a drop or two at a time, and then roll the. When it is time to remove the acrylic nails altogether, the nail tech will file down the top layer of the nails, then wrap each nail in a foil and cotton. Next, use a buffer to gently buff the surface of your nails. This will create an even canvas for the gel nail polish to adhere to and help the polish to last. Apply Gel Nail Polish Remover to a Lint Free Wipe and thoroughly clean the surface of your nails, including the area under your nails and around your cuticles. 1. Open the nail polish bottle and add two to three drops of nail polish thinner. ; 2. Use acetone or nail polish remover as a last resort. ; 3. Close the bottle. gelish. Celebrating 15 Years Of The Original Gel Polish Advanced Nail System For The Nail Professional. See all colors. Put the nail polish bottle in hot water for 2-minutes. · Use a nail polish thinner. · Use acetone or nail polish remover to thin the polish. · Use isopropyl. What it does: It helps thin thick nail polish without ruining the polishs formula. What else you need to know: Excellent for keeping nail polish at its proper. Ensure your lamp emits UV light at the correct frequency and is positioned around 2 inches from your nails for optimal curing. Do I need to cure regular nail. Nail polish can be thinned using nail polish thinner or a few drops of pure acetone. You can add a drop or two at a time, and then roll the. When it is time to remove the acrylic nails altogether, the nail tech will file down the top layer of the nails, then wrap each nail in a foil and cotton. Next, use a buffer to gently buff the surface of your nails. This will create an even canvas for the gel nail polish to adhere to and help the polish to last. Apply Gel Nail Polish Remover to a Lint Free Wipe and thoroughly clean the surface of your nails, including the area under your nails and around your cuticles. 1. Open the nail polish bottle and add two to three drops of nail polish thinner. ; 2. Use acetone or nail polish remover as a last resort. ; 3. Close the bottle. gelish. Celebrating 15 Years Of The Original Gel Polish Advanced Nail System For The Nail Professional. See all colors. Put the nail polish bottle in hot water for 2-minutes. · Use a nail polish thinner. · Use acetone or nail polish remover to thin the polish. · Use isopropyl.

Trim, file and buff nails for a clean and dry surface. Push back the cuticle. Remove shine from the natural nail with a file or a drill, especially around. M posts. Discover videos related to How to Thin Gel Polish for Airbrush on TikTok. See more videos about How to Do Gel Lines on Nails, How to Make Sheer. I had a bottle of Dior gel polish and half of the bottle was frozen on the bottle. I tried nail polish remover and really hot water but it didn't gel at all. So. Apply 1 coat of Miracle Gel™ Top Coat Easily removes with regular nail polish remover! FAN FAVORITES. REVIEWS. Directions: Add drops to Ink Gel Polish to achieve desired consistency. Shake well after each drop. Add more drops as needed. Try not to wear nail polish for one to two weeks or longer. This will allow your nails time to repair. Rehydrate your nails. Between polishes, apply a. You may have already suspected this, but unlike traditional liquid gel, this solid gel does not self-level. So please do not apply it super thin. I found that. Why I Don't Wear Gel Nail Polish Anymore I have super thin nails that break easily. Starting when I was in college and a lifeguard/swim instructor at my. How to fix slightly hardened polishes and top coats? Use our Polish Thinner to thin out nail polish colors and topcoats! Nail polish and topcoats can be. Has your Pro base or Finish Gel begun to thicken? Apply 2 to 5 drops of this Gel Thinner to help thin out your liquids and start dipping your nails again. One of the options for saving gel polish is to dilute it with alcohol or alcohol-containing liquids (for example, vodka). Has your Pro base or Finish Gel begun to thicken? Apply 2 to 5 drops of this Gel Thinner to help thin out your liquids and start dipping your nails again. Three to four coats of thin coats of gel nail polish will come out much better than two thick coats. Fix Mistakes Before Curing. There's a whole scientific. 4. Apply a thin layer over the gel polish color, covering the entire nail. 5. Place your finger in the LED lamp and cure for 30 seconds. Thin Polish dilutes your thickened SolarGel™ nail polish color and restores its original consistency. PRODUCT USE. Once you notice your SolarGel™ nail polish. Description · Buff the top, shiny layer from the Diamond Top Coat with a gentle nail file. · Soak a cotton pad with an acetone gel polish remover, put it on the. Cure (by placing all fingers) in the UV Lamp for 1 minute or LED lamp for 30 seconds. Apply Gel Polish Color in a very thin application from cuticle to free. Apply and Remove Your Red Carpet Manicure or Learn How To Use Our Different Products. RCM Assorted Supplies. RED CARPET TUTORIALS. LED Gel Polish. Color Dip. Gel polish is as thin and flexible as regular nail polish. You apply it, just like regular nail polish, on the natural nail. You cannot extend your own nails. Lacquer Refresh Nail Polish Thinner · Acetone-free, restorative formula · Transforms aged polishes, reviving them to their original, easy-to-apply state.

Mortgage 80 10 10

80/10/10 loans, where the first mortgage is 80 percent of the home value, the second mortgage or Home Equity Line of Credit (HELOC) is 10 percent, and the rest. 80/10/10 mortgage lenders structure their loans differently, but typically they are offered at the lowest rate of interest available. As rates vary over time. With Chevron Federal Credit Union's mortgage, you can put as little as 10% down, with no private mortgage insurance necessary. 80/10/10 mortgage lenders structure their loans differently, but typically they are offered at the lowest rate of interest available. As rates vary over time. 80% of the home purchase price is covered by your first mortgage; 10% comes from a second mortgage, most often a HELOC; 10% is paid for with your down payment. Understanding the Structure. The piggyback mortgage loan is named after its unique structure, which involves three components: an 80% first. The piggyback calculator will estimate the first & second loan payment for , & mortgages. In this case, a second mortgage or home equity loan is taken out at the same time as the first mortgage. With an "" piggyback mortgage, for example, The piggyback loan is a method of using two mortgages and 10% down to avoid private mortgage insurance. Here's how it works. 80/10/10 loans, where the first mortgage is 80 percent of the home value, the second mortgage or Home Equity Line of Credit (HELOC) is 10 percent, and the rest. 80/10/10 mortgage lenders structure their loans differently, but typically they are offered at the lowest rate of interest available. As rates vary over time. With Chevron Federal Credit Union's mortgage, you can put as little as 10% down, with no private mortgage insurance necessary. 80/10/10 mortgage lenders structure their loans differently, but typically they are offered at the lowest rate of interest available. As rates vary over time. 80% of the home purchase price is covered by your first mortgage; 10% comes from a second mortgage, most often a HELOC; 10% is paid for with your down payment. Understanding the Structure. The piggyback mortgage loan is named after its unique structure, which involves three components: an 80% first. The piggyback calculator will estimate the first & second loan payment for , & mortgages. In this case, a second mortgage or home equity loan is taken out at the same time as the first mortgage. With an "" piggyback mortgage, for example, The piggyback loan is a method of using two mortgages and 10% down to avoid private mortgage insurance. Here's how it works.

Purchase a new home today with only 10% down — and no PMI. A new home is a major investment. When you partner with Liberty Federal Credit Union, you can enjoy. An 80/10/10 is a conventional first mortgage that will cover 80% of the home's value or purchase price, whichever is lower. With this strategy, the homeowner makes a 5 or 10 percent down payment, gets a mortgage for 80 percent of the home's value, and then takes out a second loan for. A piggyback loan, or an 80/10/10 loan, is a mortgage that is taken out on top of another mortgage. Although it isn't quite as popular today as it was before. An 80/10/10 mortgage is a flexible tool that lets you finance your home loan through three sources, so you can keep more of your cash for other purposes. mortgage. A type of mortgage arrangement with 80 percent of the purchase price paid by a first mortgage, 10 percent paid by a second mortgage. The requirements for 80/10/10 have become more strict since the mortgage crisis, due to the added risk of lenders putting out a second loan. Piggyback. “piggyback” loans allow you to purchase a home using two separate loans that equal 90% of the home's value, and a down payment of 10%. Piggyback Second Mortgage An Piggyback Second Mortgage allows customers to make homeownership a reality with as little as 10% down. An loan is a mortgage strategy where the borrower essentially takes out three loans instead of one. The first loan covers 80% of the home's purchase. A piggyback mortgage is when you take out two separate loans for the same home. The first mortgage is usually 80% of the home's value with the second one being. The Combination Loan consists of a first mortgage from PNC for 80% of your home's value, a a PNC Bank home equity line of credit second mortgage for. My question is, how does one actually get pre-approved for an 80/10/10 loan? It's my understanding that often the two loans are from different banks. 80/10/ Commonly referred to as a piggyback loan, 80/10/10 eliminates the needs for the borrower to pay private mortgage insurance (PMI). LEARN MORE. HECM. An eighty-ten-ten loan is a financing structure used primarily in home purchasing. It splits the mortgage into three parts: an 80% main mortgage, a 10%. In this scenario, a first mortgage represents 80% of the home's value, while a home equity loan or HELOC makes up another 10%. The down payment covers the. Family moving into their new home. Mortgage Loans with Only 10% Down and No Mortgage Insurance! Packages like this are often referred to as an “ Combo mortgage loans sometimes called a Piggy-Back loan, is a program designed to help Borrower's purchase a home with % down while avoiding Mortgage. For one, you can expect to pay PMI. In most cases, lenders require private mortgage insurance on any loan that contributes more than 80% of the home purchase. Piggyback Loans ( Loans) The loan is a popular way to avoid PMI. Here's how it works: You take out a primary mortgage for 80% of the home's.

California Income Tax Brackets

Your average tax rate is % and your marginal tax rate is %. This marginal tax rate means that your immediate additional income will be taxed at this. California taxes certain items of income that are not taxed by the federal government. Below is a list of income that should be entered on your CA return. The state income tax rates range from 1% to %, and the sales tax rate is % to %. California offers tax deductions and credits to reduce your state. Wages, salary or tips where federal income taxes are withheld on Form W-2, box 1 · Income from a job where your employer didn't withhold tax (such as gig economy. Proposition 13, adopted by California voters in , mandates a property tax rate It reduced the top corporate income tax rate from 35 to 21 percent. % Note that the true California state sales tax rate is 6%. There is a statewide county tax of % and therefore, the lowest rate anywhere in California. California income tax rate: % - %; Median household income in California: $91, (U.S. Census Bureau); Number of cities that have local income taxes. caps the property tax rate for all local governments at 1 percent, requires a two-thirds majority in both houses of the state legislature for any state tax. Income tax in California is progressive, with the top tax rate of % the highest in the country. Conversely, due to refundable tax credits provided to. Your average tax rate is % and your marginal tax rate is %. This marginal tax rate means that your immediate additional income will be taxed at this. California taxes certain items of income that are not taxed by the federal government. Below is a list of income that should be entered on your CA return. The state income tax rates range from 1% to %, and the sales tax rate is % to %. California offers tax deductions and credits to reduce your state. Wages, salary or tips where federal income taxes are withheld on Form W-2, box 1 · Income from a job where your employer didn't withhold tax (such as gig economy. Proposition 13, adopted by California voters in , mandates a property tax rate It reduced the top corporate income tax rate from 35 to 21 percent. % Note that the true California state sales tax rate is 6%. There is a statewide county tax of % and therefore, the lowest rate anywhere in California. California income tax rate: % - %; Median household income in California: $91, (U.S. Census Bureau); Number of cities that have local income taxes. caps the property tax rate for all local governments at 1 percent, requires a two-thirds majority in both houses of the state legislature for any state tax. Income tax in California is progressive, with the top tax rate of % the highest in the country. Conversely, due to refundable tax credits provided to.

California has ten income tax brackets from 1% up to %. Technically, the last tax bracket is %, but there is also an additional 1% for those with a. Evidence shows that they are highly responsive to tax policy, and a new law taking effect in will raise the effective top individual tax rate to Imputed income for federal income tax (including FICA); Imputed income for California state income tax. Tax savings on insurance premiums (TIP). If you enroll. Our accounting and legal staff work to provide input on tax administration and regulations. caltax service. Elections. We engage in state and local campaigns to. How do California tax rates compare nationally? CA has a graduated state individual income tax, with rates ranging from percent to percent. Income tax rates in California vary based on an individual's income and range from 1% to %, with higher rates applying to individuals with higher income. California has ten income tax brackets from 1% up to %. Technically, the last tax bracket is %, but there is also an additional 1% for those with a. The California (CA) state sales tax rate is %. This rate is made up of a base rate of 6%, plus a mandatory local rate of % that goes directly to city. Step 1: Is your gross income (gross income is computed under California law worldwide income but applies tax rate to only. California sourced income. The state of California doesn't include Social Security retirement benefits in its income tax rates, but other forms of income can be subject to taxation, which. For illustrative purposes only. Tax rates used at $K income level for married filing jointly: 35% Federal income tax rate, % Net Investment Income Tax . Montana's rate is about average when compared to surrounding states. Table 7- State Corporate Income Tax. Rate. California*. %. Apportionment Formula. Sales. California has the highest state sales tax rate (%) in the nation, but taxes few services compared to other states. California has the 8th-highest. Hawaii has 12 tax brackets, while Kansas and six other states have only three. California's progressive tax system has the highest top tax rate of tax brackets and withholding methods do not reflect state PIT state income tax purposes as wages paid to spouses for California PIT withholding. In California, bonuses are taxed currently at a rate of %. For example, if you earned a bonus for $5,, you would owe $ in taxes on that bonus to. Given that California taxes net capital gains at the same rates as ordinary income-with a maximum rate of percent (or percent with respect to taxable. California's economy is the largest in the U.S., and on its own would represent a top national economy compared to global output. · Businesses located in. Please click on the following link to discover the applicable tax rate for your business type. State of California. Professions and Occupations. The federal income tax is inequitable because it taxes investment income, which is disproportionately earned by high-income taxpayers, at a lower rate than wage.

Coinbase Tax Doc

Go back to the page with your tax forms on it and click on the PDF button. It should open a new tab/window that lets you download the form. IRS Form is a rundown of your foreign financial assets. These assets include things like bank accounts and cryptocurrency held in a foreign Coinbase. Coinbase Taxes will help you understand what kotyonok.site activity is taxable, your gains or losses, earned income on Coinbase, and the information and reports. Bitcoin Tax Forms · Form IRS Form is used to report all bitcoin transactions, including dates, cost basis, and any gains or losses. · Form Coinbase Taxes will help you understand what kotyonok.site activity is taxable, your gains or losses, earned income on Coinbase, and the information and reports. Reporting your crypto activity requires using Form Schedule D as your crypto tax form to reconcile your capital gains and losses and Form if necessary. You can generate your gains, losses, and income tax reports from your Coinbase investing activity in minutes by connecting your account with CoinLedger. Download a TurboTax gain/loss report from Documents in Coinbase Taxes for the tax year you're reporting from. · Upload the file directly into TurboTax. It's important to note: you're responsible for reporting all crypto you receive or fiat currency you made as income on your tax forms, even if you earn just $1. Go back to the page with your tax forms on it and click on the PDF button. It should open a new tab/window that lets you download the form. IRS Form is a rundown of your foreign financial assets. These assets include things like bank accounts and cryptocurrency held in a foreign Coinbase. Coinbase Taxes will help you understand what kotyonok.site activity is taxable, your gains or losses, earned income on Coinbase, and the information and reports. Bitcoin Tax Forms · Form IRS Form is used to report all bitcoin transactions, including dates, cost basis, and any gains or losses. · Form Coinbase Taxes will help you understand what kotyonok.site activity is taxable, your gains or losses, earned income on Coinbase, and the information and reports. Reporting your crypto activity requires using Form Schedule D as your crypto tax form to reconcile your capital gains and losses and Form if necessary. You can generate your gains, losses, and income tax reports from your Coinbase investing activity in minutes by connecting your account with CoinLedger. Download a TurboTax gain/loss report from Documents in Coinbase Taxes for the tax year you're reporting from. · Upload the file directly into TurboTax. It's important to note: you're responsible for reporting all crypto you receive or fiat currency you made as income on your tax forms, even if you earn just $1.

Coinbase Tax Documents At present, Coinbase reporting is done with Form MISC. However, it is possible that the exchange will begin issuing Form It's important to note: you're responsible for reporting all crypto you receive or fiat currency you made as income on your tax forms, even if you earn just $1. You can view and download your tax documents through Coinbase Taxes. Tax reports, including s, are available for the tenure of your account. If you use Coinbase, you can sign in and download your gain/loss report using Coinbase Taxes for your records, or upload it right into TurboTax whenever you're. You can find all of your IRS forms in the Documents section of your Coinbase Tax Center. Coinbase no longer issues an IRS Form K. You can find all of your IRS forms in the Documents section of your Coinbase Tax Center. Coinbase no longer issues an IRS Form K. Coinbase customers will be able to generate a Gain/Loss Report that details capital gains or losses using the cost basis specification strategy in their tax. What benefits do I get if I use CoinTracker for crypto tax reporting? · Free tax reporting on up to Coinbase Wallet transactions (only valid for new. Coinbase earnings are taxable only when you transfer, sell, exchange or do something with it. Coinbase earns just sitting idly in your wallet is not taxable. What tax forms do I need to file for income taxes if I sold Bitcoin during the If you sold bitcoin you may need to file IRS Form and a Schedule D. General information. Coinbase tax information · Taxes for Singapore customers ; Forms and reports. IRS Form MISC · Download your tax reports ; Tools. Coinbase reports Form MISC for customers who've earned more than $ of income through means such as staking and referrals. · Starting in the tax year. Browser · Sign in to your Coinbase account. · Select avatar and choose Taxes. · Select the transaction in Your tax activity. The transaction is labeled with. Currently, Coinbase One subscribers are eligible for a pre-filled Form The Form is available back through tax year Related article. Starting in the tax year, American exchanges will be required to issue Form DA — detailing gains and losses from crypto-assets. Does Coinbase hand. American expats with Coinbase accounts may need to report their holdings to the IRS if they live overseas. To do this, you'll have to file IRS Form when. You must report ordinary income from virtual currency on Form , U.S. Individual Tax Return, Form SS, Form NR, or Form , Schedule 1, Additional. Download a TurboTax gain/loss report from Documents in Coinbase Taxes for the tax year you're reporting from. Upload the file directly into TurboTax. Using. Here's how to get your CSV file from kotyonok.site in to your Coinbase kotyonok.site the Taxes section, select the Documents kotyonok.sitete and download the. Only U.S.-based Coinbase users who earn $ or more in crypto income will receive IRS MISC tax forms to report their earnings to the IRS during the tax.

Natural Gas Market Price Today

Discover the latest natural gas price today and trace the historical value of the commodity over the years with kotyonok.site's natural gas chart. News. The energy charge on your bill is determined by the open and competitive natural gas market. Current gas rate approvals. Default utility provider rate. Explore real-time Natural Gas Futures price data and key metrics crucial for understanding and navigating the Natural Gas Futures market. The current price of Natural Gas Futures is USD / MMBTU — it has risen % in the past 24 hours. Watch Natural Gas Futures price in more detail on the. Type: Commodity ; Group: Energy ; Unit: 1 Mmbtu ; Prev. Close: ; Open: The September Nymex gas futures contract on Wednesday limped along early on its last day at the front of the curve. It was down cents to $/MMBtu as of. Henry Hub Natural Gas Spot Price is at a current level of , up from the previous market day and down from one year ago. Analysis of natural gas prices and also developments in the natural gas sector. Shale gas and new fracking techniques are covered in detail. Natural Gas Price Forecast: Extends Losses, Testing Critical Support Levels ; WTI Oil. $ CL. (%) ; Brent Oil. $ BCO. (%). Discover the latest natural gas price today and trace the historical value of the commodity over the years with kotyonok.site's natural gas chart. News. The energy charge on your bill is determined by the open and competitive natural gas market. Current gas rate approvals. Default utility provider rate. Explore real-time Natural Gas Futures price data and key metrics crucial for understanding and navigating the Natural Gas Futures market. The current price of Natural Gas Futures is USD / MMBTU — it has risen % in the past 24 hours. Watch Natural Gas Futures price in more detail on the. Type: Commodity ; Group: Energy ; Unit: 1 Mmbtu ; Prev. Close: ; Open: The September Nymex gas futures contract on Wednesday limped along early on its last day at the front of the curve. It was down cents to $/MMBtu as of. Henry Hub Natural Gas Spot Price is at a current level of , up from the previous market day and down from one year ago. Analysis of natural gas prices and also developments in the natural gas sector. Shale gas and new fracking techniques are covered in detail. Natural Gas Price Forecast: Extends Losses, Testing Critical Support Levels ; WTI Oil. $ CL. (%) ; Brent Oil. $ BCO. (%).

Today's Natural Gas prices with latest Natural Gas charts, news and Natural Gas futures quotes. Price (USD) · Today's Change / % · Shares tradedk · 1 Year change% · 52 week range - The portion of your bill that you pay to ATCO Gas covers our costs to safely and reliably distribute natural gas to your home Current Rates. Products. Guaranteed, regulated, variable utility jargon can be confusing. There are a variety of rate options available in Alberta's natural gas market. Get the latest Natural Gas price (NG:NMX) as well as the latest futures prices and other commodity market news at Nasdaq. Today's news · US · Politics · World · Tech · Reviews and deals · Audio · Computing Oil. Henry Hub: The Henry Hub price is forecast to decline slightly to US$/MMBtu in and rebound to US$/MMBtu by Long-term demand is anticipated to. Interactive chart illustrating the history of Henry Hub natural gas prices. The prices shown are in U.S. dollars. The current price of natural gas as of August. This page includes full information about the Natural Gas, including the Natural Gas price today and dynamics on the chart by choosing any of 8 available time. Natural Gas Futures - Oct 24 (NGV4) · Prev. Close: · Open: · Day's Range: - Crude Oil & Natural Gas ; JPY/kl, 71,, , % ; USD/MMBtu, , +, +%. Prices displayed in Trading Economics are based on over-the-counter (OTC) and contract for difference (CFD) financial instruments. Our natural gas market prices. Follow live natural gas prices with the interactive chart and read the latest natural gas news, analysis and forecasts for expert trading insights. GO IN-DEPTH ON Natural Gas (Henry Hub) PRICE ; Natural Gas (Henry Hub). %. ; Heating Oil. %. Spot Price. ; Contract L/H · ; Average Price(₹ / 1 mmBtu). ; Open Interest(Contracts). ; Open Interest Change. Graph and download economic data for Henry Hub Natural Gas Spot Price (DHHNGSP) from to about natural resources, gas, price, and USA. Natural gas market data · EEX European Gas Spot Index (EEX EGSI) · EEX Next Day Index (NDI) · EEX Neutral Gas Price (NGP) · EEX Gas Price Reference EGIX (Germany). Énergir's Network Gas Prices. Énergir's natural gas supply rate and the compression gas price for the current month and the previous mont. Price effective. Alberta Natural Gas Prices - Current Month. Actual prices are based on a volume weighted average of transacted prices for all physically delivered natural gas. Find the latest Natural Gas Sep 24 (NG=F) stock quote, history, news and other vital information to help you with your stock trading and investing.

Sell Plasma Charlotte Nc

Your plasma donation helps create critical, life-saving medicines, and you can be gratefully rewarded for your generosity. Donating plasma saves and improves lives. CSL Plasma is one of the largest collectors of human plasma. Questions? Contact your local CSL Plasma center or. Find information for the CSL Plasma Donation Center in Charlotte, NC, including hours, services, and directions. Do the Amazing and Donate Plasma today! Octapharma Plasma collects life-saving medicines for patients. Charlotte, North Carolina, United States. $20 to $50 per donation. Payment is for time/inconvenience, pain. Unit of plasma costs hospitals $+. Uses: hemophiliacs, albumin for burns. Blood donors report feeling a sense of great satisfaction after making their blood donation. Why? Because helping others in need just feels good. Donate. Empowering Your Plasma Donation Experience · Reagan Drive Ste 1 Charlotte, NC · Phone: () · Hours: Mon-Sat am – pm · Located in. Find a BioLife Plasma center near you! Learn how you can help by donating plasma at a plasma center near you North Carolina · North Dakota · Ohio · Oklahoma. Top 10 Best Paid Plasma Donation Centers Near Charlotte, North Carolina · CSL Plasma · Grifols · Talecris Plasma Resources · Octapharma Plasma - South Blvd. Your plasma donation helps create critical, life-saving medicines, and you can be gratefully rewarded for your generosity. Donating plasma saves and improves lives. CSL Plasma is one of the largest collectors of human plasma. Questions? Contact your local CSL Plasma center or. Find information for the CSL Plasma Donation Center in Charlotte, NC, including hours, services, and directions. Do the Amazing and Donate Plasma today! Octapharma Plasma collects life-saving medicines for patients. Charlotte, North Carolina, United States. $20 to $50 per donation. Payment is for time/inconvenience, pain. Unit of plasma costs hospitals $+. Uses: hemophiliacs, albumin for burns. Blood donors report feeling a sense of great satisfaction after making their blood donation. Why? Because helping others in need just feels good. Donate. Empowering Your Plasma Donation Experience · Reagan Drive Ste 1 Charlotte, NC · Phone: () · Hours: Mon-Sat am – pm · Located in. Find a BioLife Plasma center near you! Learn how you can help by donating plasma at a plasma center near you North Carolina · North Dakota · Ohio · Oklahoma. Top 10 Best Paid Plasma Donation Centers Near Charlotte, North Carolina · CSL Plasma · Grifols · Talecris Plasma Resources · Octapharma Plasma - South Blvd.

Open every day, yes weekends too, means donating at a center is easy to fit into your schedule. *Platelet, plasma, whole blood, and automated red cell donations. Why donate plasma? Get paid for your plasma donation and earn extra with bonuses and referrals. The more often you donate, the higher your donation payment. RF W79X0W–Charlotte, NC, USA July A man stands outside the the Octapharma Plasma Center on South Blvd. heart_plus. download shopping_cart. most needed items · Clothing · Shoes · Furniture · Flat screen televisions (LED, LCD, plasma) · Domestics (e.g. sheets, towels) · Collectibles, jewelry, antiques. Charlotte NC Schedule Appointment Driving Directions. This Grifols center offers: DonorHub™. Plasma donation requirements: 1. Must. With more than 40 donation sites in the Charlotte metro area – including Charlotte Charlotte, NC Billing Address: P.O. Box Charlotte, NC Operates + plasma donation centers in retail shopping areas across 35 Headquartered in Charlotte, NC; employs 3,+ nationally. Dedicated to. The plasma you donate will be used in medicinal products that treat severe and rare diseases. Donation is safe and you'll be compensated: learn more! Plasma Donation Centers In Jacksonville, NC Find the best plasma donation centers for new donor and returning donor pay within 50 miles. Become a plasma donor and help save lives while earning money at ADMA BioCenters · Donate Plasma · New donors! · Additional $10 Bonus on Your 2nd Plasma Donation. Talecris Plasma Resources, Inc. is located at A Freedom Drive. You will enjoy donating with us because of our great team and our proximity within the city. Highest paying plasma donation centers in Charlotte, NC · kotyonok.sites Talecris - Plasma Donation Center. A Freedom Dr · kotyonok.sites Talecris. A Freedom Drive, Charlotte, North Carolina, jl marker2 IQPP Moncreiffe Rd, Raleigh NC jl marker2 IQPP Certified. Highest paying plasma donation centers in Concord, NC · kotyonok.sites Talecris - Plasma Donation Center. S Cannon Blvd · kotyonok.sites Talecris -. Octapharma Plasma · () Reagan Dr Suite 1 · ; Talecris Plasma Resource · () Freedom Dr · ; Octapharma Plasma. LFB Plasma operates plasma collections centers in Alabama, Colorado, Florida, North Carolina and South Carolina. Donors, who are compensated for each donation. Octapharma Plasma, Inc.'s main headquarters is located at Westlake Drive Charlotte, NC US. The company has employees across 5 continents. Donating plasma is a safe, easy, low-risk procedure with little to no side effects. It can take longer than donating blood but is time well spent in a. Parachute is the easiest way to earn extra money by donating plasma. Earn up to $ for your first two donations. KedPlasma, LLC · () 2nd St NE ; Plasma Biological Service · () Ashe St ; KED Plasma · 1 W. Walnut ; Physicians Plasma Alliance, LLC.